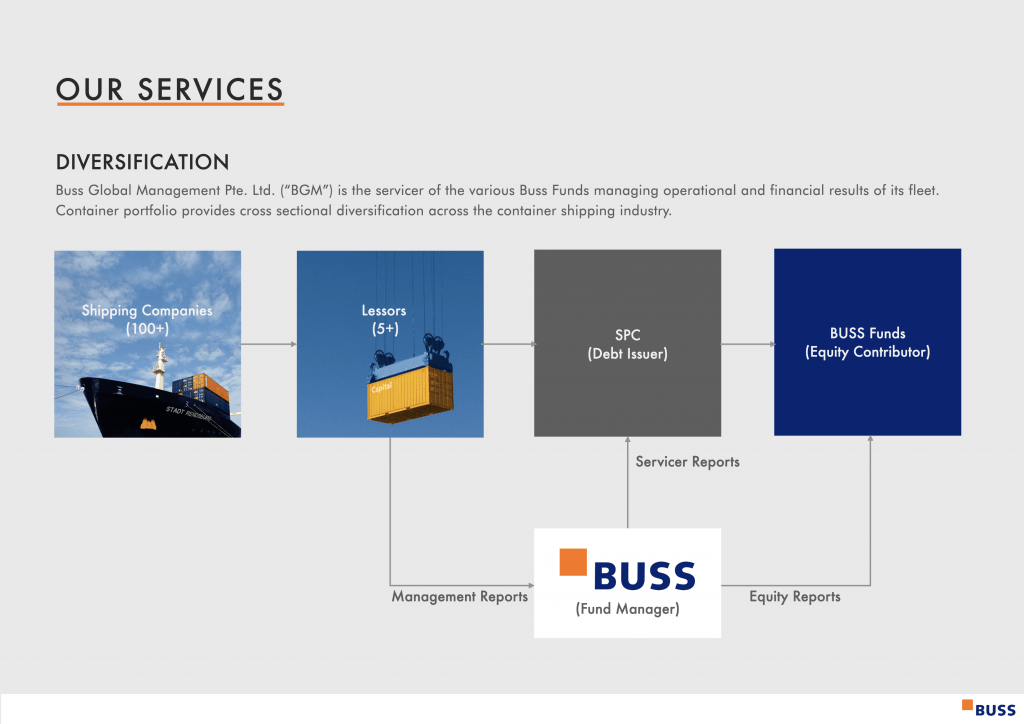

Containers

CONTAINERISATION: A PRIMER

ASSET TYPES

Asset & Diagram

Description

Standard Drys (“Drys”)

- Purpose: Maritime/Road transport of general cargo

- Description: 20’ x 8’ x 8’6” / 40’ x 8’ x 8’6” / 40’ x 8’ x 9’6” corten steel box

- Useful Life: 12-15 years

- Market: International – Global maritime trade routes

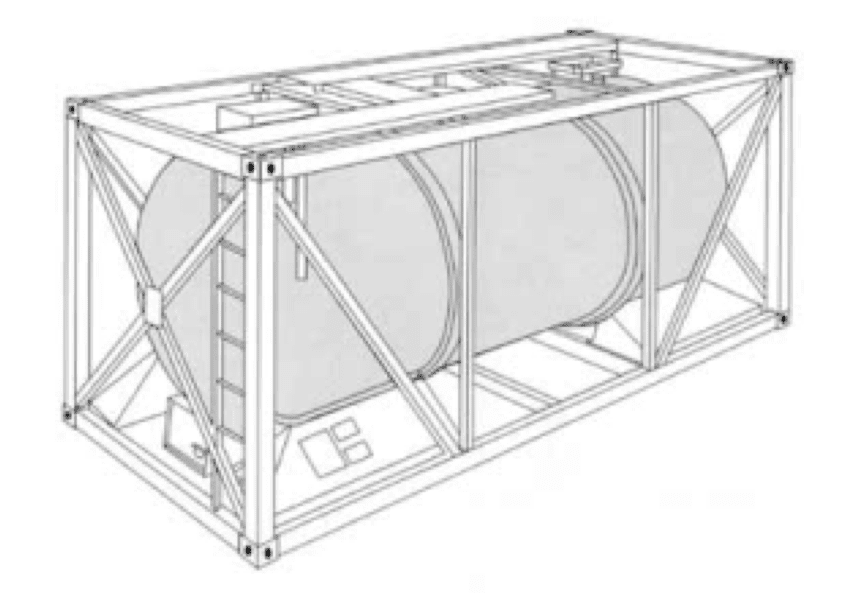

Tanks (“Tank”)

- Purpose: Maritime transport of liquids or semi-fluids

- Description: Insulated and steam-heated stainless steel cylinder

- Useful Life: 15-20 years

- Market: International – Global maritime trade route

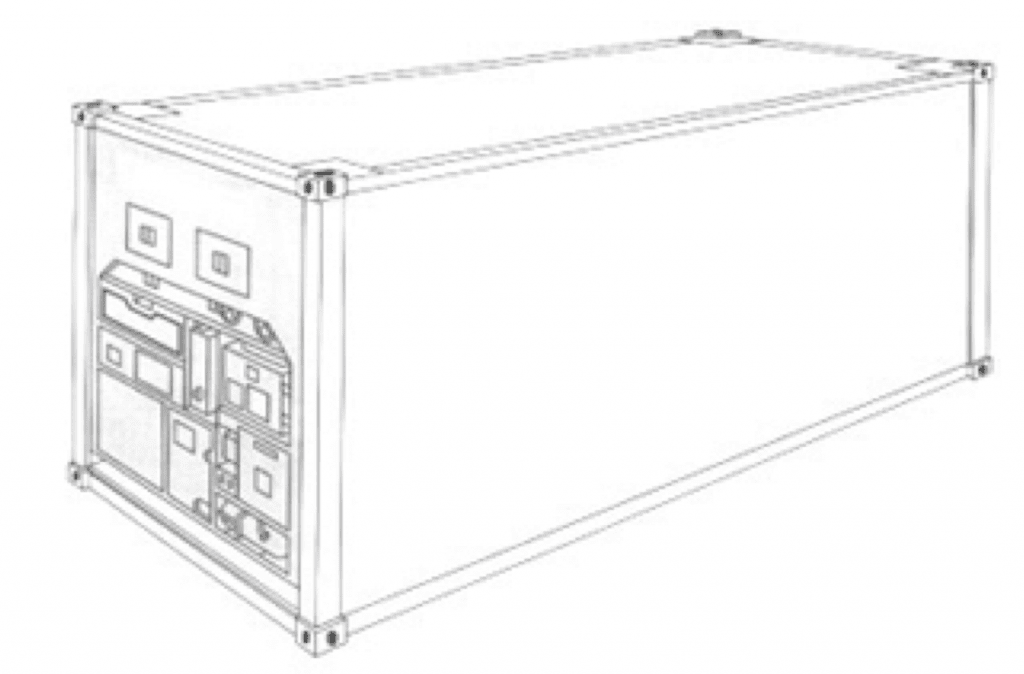

Refrigerated (“Reefers”)

- Purpose: Maritime/Road transport of general cargo

- Description: 20’ x 8’ x 8’6” / 40’ x 8’ x 9’6” corten steel box with refrigerated unit

- Useful Life: 10-12 years

- Market: International – Global maritime trade routes

VALUE UNDERPINNING – CONTAINER LIFE CYCLE ANALYSIS

Container box versatility extend their useful life, while allowing box to retain good value over time. Highly interchangeable across lessees, lessors and owners due to its commoditized nature.

Marine containers have several lives, creating a strong secondary market which bolsters residual values.

Phase 1 (age 1 - 15)

Primary Use: Marine container used by shipping lines

Advantages: Standardization of boxes contribute to a high recovery rate

- The large majority of container boxes are made to standard specifications, which limits obsolescence risk upon lease maturity or a lessee default but also limit the amount of time a box will stay in storage between leases

- Upon default of a lessee, managers can simply repossess the boxes and re-lease these to a new creditworthy counter-party

- Utilization: Average of 90-95% utilization during Phase 1

Phase 2 (> age 15)

Primary Use: Storage / Housing

Advantages: High Versatility of marine container boxes

- Marine containers are originally leased to shipping lines to transport goods around the world, however they prove to be extremely versatile, which sustain a strong secondary market post shipping line leasing

- Marine containers are used for a variety of means such as Residential / Commercial / Construction / Storage Space

- Residual value: 40%-50% of OEC in Phase 2 due to multiple uses

Phase 3 (end of life)

Primary Use: Containers are recycled

Advantages: High scrap value of primary material

- Boxes can ultimately be sold for their scrap value (mainly steel)

- Valuable Core: End of life use would be to scrap the container for steel. High end-of-life value in Phase 3 allows for higher price to be achieved in Phase 2

CONTAINERs AS AN ASSET CLASS

INVESTMENT PROPOSITION

Long history of stable returns. Buss Global has a strong, proven and consistent track record in container investments across various

investors groups.

Stable Investment Sector

A. Long Term Demand Growth

- Inelastic demand: YTD Container port throughput in Shanghai and Singapore through Aug 20 dipped by only 2% despite the global pandemic

- 1.5x: Ratio of 2019 Container Throughput Growth relative to Global GDP

B. Supply Side Discipline

- 90% Market Share: Containers are fabricated by 4 manufacturers in China

- Storage of Value: Oligopolistic pricing has been observed to maintain box value

C. Stable Utilization, Stable Earnings

- 90 – 95%: Average utilization since 2003. Current utilization at 95%

- Stable ROA: All investment targets achieved across Buss Global

Good Market Timing

A. Long Term Average Prices

- $2,200+ New Builds: Current prices are seen to be fair value considering material prices and demand outlook

- 2021: Attractive as demand remains strong with cash yields increasing to 11% amid high secondary prices

B. Rising Interest Rate Environment

- Strong Correlation: Cash yields have historically tracked interest rate movements closely

- Cash Yields: Approx 10%

Proven Servicing Partner

A. Experienced Servicer

- BGM: Possesses a proven track record having been involved in container investments since 2003

- $3 Bn+: Investments in containers over since inception

- AUM: Largest 3rd party asset owner

B. Organic and Acquisition Growth

- Acquisition Growth: BGM have container investments with all the leading container lessors

C. Access to Capital Markets

- Equity: German retail forms the base. Added US and Asian institutional Investors

- Debt: Strong support from European and American banks. Maintains access to US ABS markets